8 February 2024

HUAT AH!

It is the time of the year again where families get together to celebrate the upcoming Chinese New Year (CNY). CNY has always been an occasion to look forward to as it is a precious opportunity to reconnect with relatives and indulge in yummy CNY dishes that appear exclusively during CNY.

Amid the festivities, what is most likely to fascinate the younger ones is the ability to exchange two mandarin oranges for a beautifully adorned Ang bao brimming with blessings and most importantly money!

Ang baos are something that everyone, who is still young enough and not yet married, looks forward to. Not sure if this is relatable but ang bao money is usually given to our parents for safekeeping and never to be seen again. Even if we were to safekeep our own ang bao money, it will soon deplete due to impulsive spending or the lack of financial planning.

So, is there a way to leverage on this additional, once a year, cash flow?

Well, the answer is yes! Here’s the secret: Let your ang bao money work for you through certain investment instruments!

Intrigued? Let’s begin!

#1 Bank Fixed Deposits

Across the financial landscape, virtually every bank offers you the option to lock in a predetermined minimum sum of capital to yield a specified interest rate over a set lock-in period. You can see this as lending money to the bank for a certain period of time and in return the bank returns you what was borrowed and a bit more.

Bank fixed deposits stand out as one of the most secured investment tool available as the return of capital is almost guaranteed unless in a very unfortunate case where the bank defaults.

As such, fixed deposits allows for young GEN Zs to grow their ang bao money rather safely.

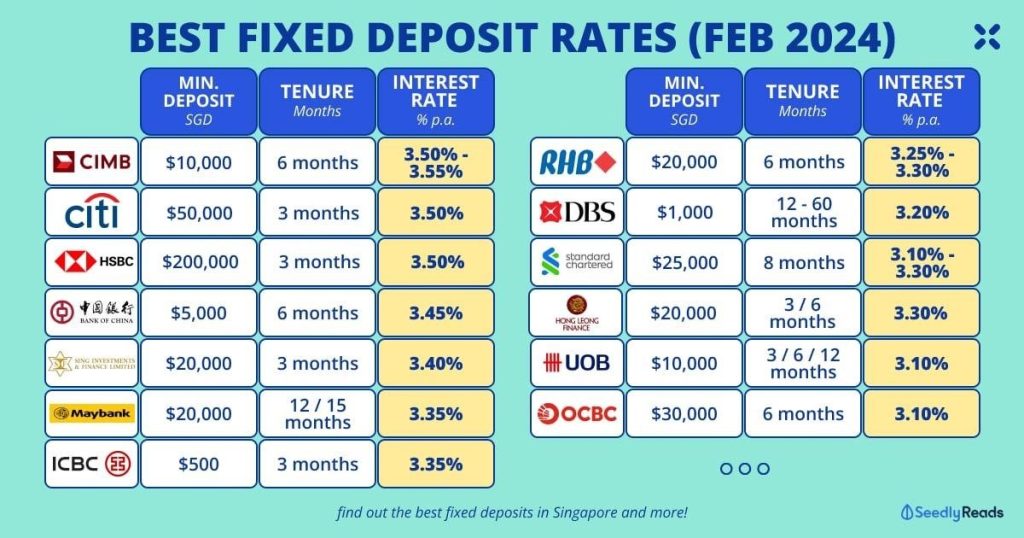

Below is an image comparing the fixed deposit rates (as of Feb 2024).

As seen from the table above, different banks present varying minimum deposit requirements and interest rate offerings. While this is a considerably safe investment tool, it’s important to note that the lock-up period typically spans a minimum of 3 months and will pose a challenge for individuals with limited available capital.

Consequently, this might only be possible for individuals with surplus funds in their savings account and lack an immediate use for it.

Do note that most of the banks only allow for individuals age 18 years and older to open a fixed deposit account with the exception of Standard Chartered (15 years old and above), Hong Leong Finance (15 years old and above) and Maybank (16 years old and above).

#2 Treasury Bills

Ever heard of T-bills?

Treasury bills or T-bills refer to short-term Singapore Government Securities (SGS) issued at a discount from their face value, based on a fixed interest rate, and are repaid in full upon maturity.

In short, T-Bills can be seen as a short-term zero-coupon bond, i.e. You are lending money to the Government.

Here’s how it works: When an individual decides to invest in a six-month T-bill worth S$1000 with a yield of 3.5% p.a.. In this case, he will only have to pay S$965 at the start. At the end of the tenor, which is 6 months later, this individual will receive the S$1000 back in full and therefore the net earning is S$35.

T-bills is another form of secure investment option. T-bills in Singapore have AAA Credit Rating and is backed by the Singapore Government. Additionally, interest income earned on SGS is also tax exempt.

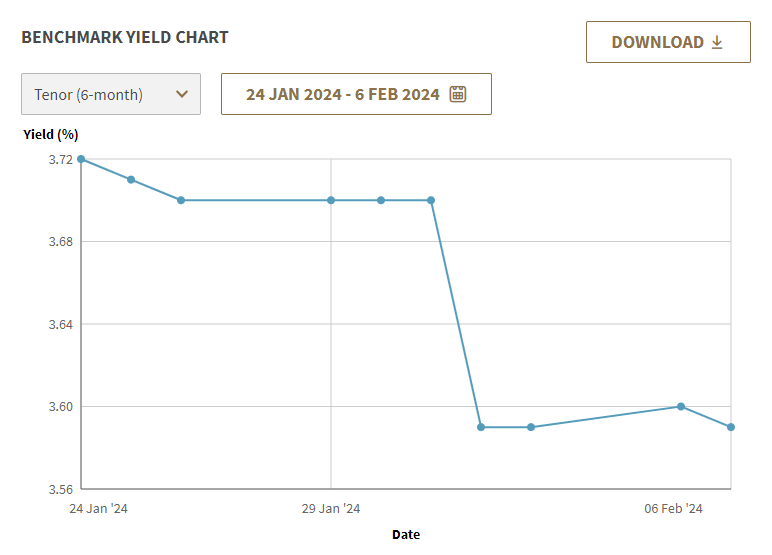

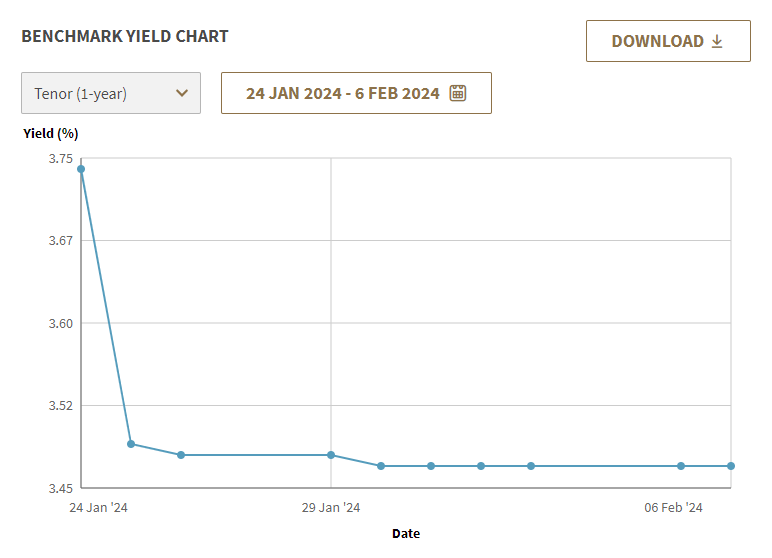

As shown from the charts above, as of writing this article on 6 February 2024, the 6-months yield is at 3.59% p.a. while the 1-year yield is at 3.47% p.a..

Based on the graph above, it suggests that considering T-bills over fixed deposits could be advantageous due to the relatively shorter lock-in period and potential for slightly higher returns.

Note that individuals have to be at least 18 years old and have opened a CDP Securities Account with Singapore Exchange (SGX) in order to invest in T-bills.

To apply for a CDP Securities Account with Singapore Exchange, click here.

#3 Money Market Funds

Lastly, let us discuss about Money Market Funds (MMFs).

MMFs is a type of unit trust fund that invests in highly liquid and short-term investment instruments that are close to maturity.

Such instruments include Bankers’ Acceptances, Certificates of Deposits, Commercial Papers and Government Treasuries.

Returns from these instruments are dependent on the prevailing interest rates in the market which suggests that fluctuations in interest rates will impact the returns of MMFs.

Unlike Fixed Deposits and T-bills, money invested into MMFs are highly liquid and can be withdrawn at any given time without being penalised.

One such example of a Money Market fund is the SMART Park offered by PhillipCapital. Return rates are refreshed every week dependent on underlying investments. As of the week of 5 February 2024, the return (7 Day) Annualised is at 3.7208% p.a. as shown below.

PhillipCapital’s SMART Park might be a favourable investment tool for individuals with smaller capital and want high liquidity in their investment. This can also be used as a temporary holding ground for investors to park their capital and generate a higher yield as they wait for opportunities to surface in the market.

Phillip SMART Park is one smart way to grow your ang bao in a low risk manner with no lock-in period. To find out more, click here.

Due to the high interest rate environment now, MMFs tend to offer relatively higher returns compared to fixed deposits and T-bills. However, it’s important to note that MMFs returns may decrease if interest rates begin to fall.

In summary, MMFs provide investors with the opportunity for potentially higher returns coupled with higher liquidity and flexibility, but their returns are susceptible to changes in market interest rates.

To access Money Market Funds, one can use the POEMS 3.0 Mobile App. Find out more by asking your Wealth Managers from TWSG.

In Conclusion

The investment tools discussed are just a few among many options available to grow your ang bao money. Given the ever-changing global economic environment, there is no single, timeless approach to growing your money.

To end off, if we are fortunate enough to not have to worry about cash flow at the moment, we can also always consider giving back to the community by donating the ang bao money you have collected to support charitable causes that are meaningful to you.

With that, our team at TWSG wishes you a year of abundance and prosperity ahead as we usher in the Year of the Dragon!

Author:

Aaron Ang

Edited by:

Yee Shen Hao

![]()