What is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme (SRS) is a voluntary savings program in Singapore aimed at helping individuals build a more robust retirement plan while enjoying attractive tax benefits. For many, SRS serves as an excellent complement to CPF savings, providing additional opportunities to grow wealth for their golden years.

Why Contribute to SRS?

#1 Attractive Tax Relief

Contributions to SRS are eligible for dollar-for-dollar tax relief, reducing your taxable income for the year. This can translate into significant savings, particularly for high-income earners.

- S’pore Citizens/PRs: Up to S$15,300 annually.

- Foreigners: Up to S$35,700 annually.

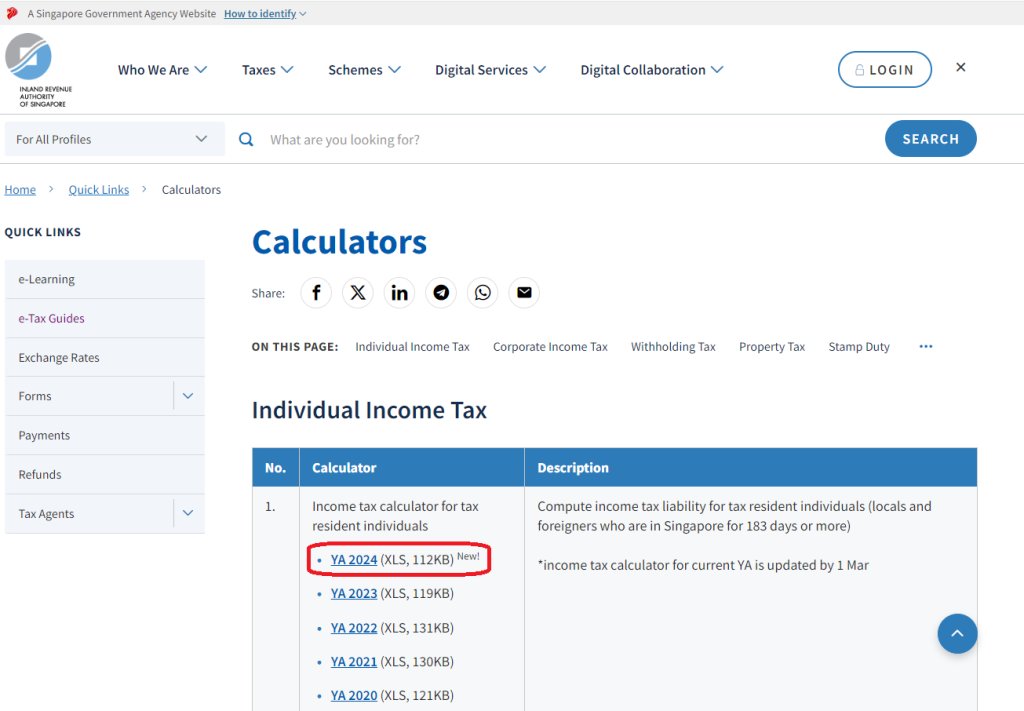

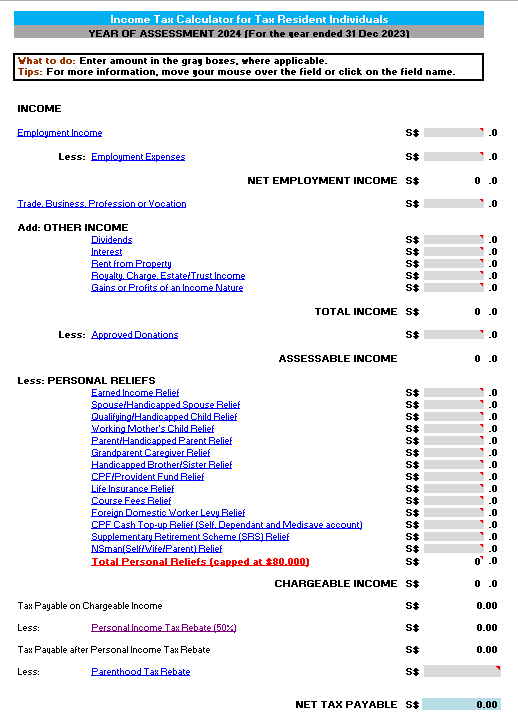

Note that there is a personal income tax relief cap of S$80,000 each year – inclusive of the tax relief for SRS top-ups. You may use the tax calculator available on the IRAS website to see whether/how much you should contribute given your assessable income and other available reliefs to maximise tax savings.

Source: IRAS – Tax Calculator

The image below shows how the calculator looks like:

#2 Tax-Deferred Growth

SRS funds enjoy tax-deferred growth. Investments made with your SRS savings—whether in stocks, bonds, or other financial products—grow tax-free until withdrawal, allowing your wealth to compound over time.

#3 Partial Taxation at Withdrawal

Only 50% of your SRS withdrawals after the statutory retirement age are taxable. With a lower income post-retirement, you can further minimize your tax burden.

Once you begin withdrawals after the statutory retirement age (currently 63), you have a 10-year window to make penalty-free withdrawals starting from the date of your first withdrawal. This allows you to manage your taxable income efficiently while accessing your savings gradually.

Pro-tip: If you withdraw up to S$40,000 annually during retirement and have no other income, the taxable amount (S$20,000) could fall within the tax-exempt bracket, effectively making your withdrawals tax-free.

By spreading withdrawals, you can minimize taxes while enjoying a steady, potentially tax-free income stream in retirement.

However, note that because the tax benefits under the SRS are given to incentivise saving for retirement, withdrawals made before the prescribed retirement age may result in penalties being imposed in most circumstances, except those made under exceptional circumstances as shown below:

| Type of withdrawal | Amount subject to tax | 5% penalty imposed? |

Penalty-free withdrawal | Withdrawal on or after prescribed retirement age (withdrawal can be spread over 10 years from the date of first penalty-free withdrawal) | 50% of withdrawal sum | No |

| Withdrawal on medical ground (physical or mental incapacity; partial withdrawal on grounds of terminal illness) | 50% of withdrawal sum | No |

| Withdrawal in full due to terminal illness | 50% of full withdrawal sum less an exempt amount of up to $400,000 | No |

| In the event of bankruptcy | 100% of withdrawal sum | No |

| Withdrawal in one lump sum by a foreigner (with at least 10 years holding period) | 50% of lump sum | No |

Other withdrawals | Early withdrawals before prescribed retirement age | 100% of withdrawal sum | Yes |

Learn more about specific withdrawal circumstances from the IRAS website at this link.

When and How to Start Contributing to SRS?

All SRS contributions must be made by 31 Dec of the year or as required by your SRS operator, to be eligible for SRS tax relief in the following Year of Assessment following the year of contribution.

Pro-tip: As mentioned, you can begin withdrawing funds penalty-free from your SRS account once you reach the statutory retirement age that was in place when you made your first contribution.

For example, if you contributed when the statutory retirement age was 63 (effective from 1 July 2022), any subsequent changes to the retirement age (e.g., to 65) will not affect you.

The statutory retirement age will rise to 64 on 1 July 2026, and increase to 65 by about 2030. Therefore, even if you currently do not need the SRS tax benefit, it still makes sense to open an SRS account now to “lock in” the current statutory retirement age for withdrawals.

To start contributing to your SRS account, you need to first open an SRS account with one of the three SRS operators in Singapore:

Make Your SRS Work Harder with Smart Investments

While contributing to SRS is a step in the right direction, keeping funds idle in your SRS account means missing out on growth as funds that we contribute to our SRS account earn only nominal bank interest rates. With inflation eroding purchasing power over time, it’s essential to invest your SRS savings to generate higher returns and protect your financial future.

SRS funds can be invested in a wide variety of financial instruments, such as:

- Unit Trusts (UTs)

- Stocks and ETFs

- Bonds and fixed deposits

- Insurance and annuity plans

By choosing the right investment strategy, you can balance risk and reward to grow your retirement nest egg while staying aligned with your financial goals.

You may also want to consider TWSG’s flagship portfolios, which are available for SRS investing.

Start Small, Think Big

You don’t need to be a financial expert to make your SRS funds work harder. Investing through a professionally managed portfolio offers diversification, flexibility, and professional oversight to optimize returns. Over time, consistent growth can translate into substantial gains.

Take Charge of Your Retirement Today

The SRS provides you with both a tax advantage and a platform to grow your wealth. While saving is crucial, investing wisely is what will set you apart in the long run.

If you’re ready to explore opportunities to grow your SRS savings, consider speaking with our Wealth Managers. Together, we can help you make informed decisions to secure a more comfortable and confident retirement.

Written By:

Justin Ng

Edited by:

Yee Shen Hao

If you enjoyed this article, don’t miss TWSG’s quarterly investment seminar on Tuesday, 14 January 2025, where we’ll dive into President Trump’s upcoming policies and discuss portfolio positioning for 2025. We’ll also cover important insights on legacy planning.

The session will be hosted by TWSG’s Director & Portfolio Manager, William Lim, and Wealth Manager, Fion Ho.

Dinner will be provided!

![]()