Why You Need to Invest: Inflation Will Erode Your Savings

Saving money feels like a responsible move, but inflation silently erodes your purchasing power over time. To give you a real-world example, McDonald’s ice cream used to cost 50 cents when I was a student in secondary school back in the early 2010s; today, that same cone costs $1.20. This 140% price increase shows the long-term impact of inflation. If inflation averages 3% per year—which is historically the case in Singapore—prices double roughly every 24 years.

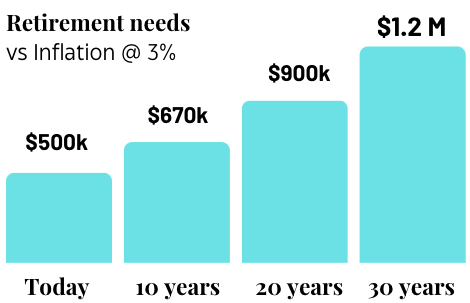

Now, let’s consider your retirement savings. You might imagine needing $500,000 for a comfortable retirement today, by the time you retire in 30 years, inflation could push that figure to nearly $1.2 million if we assume a 3% annual inflation rate.

But inflation is only one side of the story. By investing your money consistently over time, you can grow your savings and outpace inflation. Let’s break it down: assume you tirelessly save up $1,000 per month for the next 40 years for your retirement at 0% interest. After 40 years, you would save $480k. Instead, if you invested the same amount of money at an average return of 6% per year, your money could have grown to around $2 million, which increases your retirement nest egg by 4 folds. That’s the power of compound growth—your investments generate returns, and those returns generate even more returns. It’s how your money works for you.

The Dilemma: Wealth Managers, Financial Advisors, Insurance Agents, and Bankers

Most of us know that investing is critical to growing our wealth, but finding the time and expertise to manage it can be overwhelming. With busy jobs and family responsibilities, most working adults turn to professionals like wealth managers, financial advisers, insurance agents, or bank relationship managers for advice.

Here’s the catch: while these professionals can provide valuable guidance, many are incentivized to push high-fee solutions that benefit them more than you. By working with advisors who don’t fully explain the risks or fees, you risk ending up with investments that don’t align with your financial goals or risk tolerance. It’s essential to choose your advisor carefully and always ask for clarity on fees, risks, and alternative options.

Investment Returns: It’s Not Just About Performance, It’s About Net Returns

When we talk about investment returns, many people focus on the gross performance of the assets, but it’s the net returns—what’s left after fees—that really matter. This is where a lot of investors fall into traps set by high-fee products.

Let’s say you’re offered an investment with a 8% annual return, but it comes with a 3% management fee. While 8% sounds great, once you deduct fees, your actual return is 5%. Now compare that with a lower-risk investment offering 6% gross returns but with a 1% fee. Your net return here would be 5% as well, but with less risk.

Over time, the difference in fees can have a significant impact. Consider this: if you invest $100,000 with a 8% net return over 40 years, your portfolio will grow to $2,172,452. But if you’re stuck with 8% returns and 3% fees (netting you 5%), that same portfolio would only reach $703,999. That’s a difference of nearly $1.4 Million over 40 years—all due to fees.

This is why it’s crucial not just to look at the performance numbers but to calculate the net return after fees. Sometimes, a lower performance, lower-fee solution is more beneficial, especially when it reduces overall risk while maintaining competitive returns.

The Typical Advice:

Insurance Agents

One of the most common products insurance agents push is Bundled products. These policies combine life insurance coverage with investments, but the complexities and high fees often make them less effective than they appear.

Benefits:

- They provide dual benefits: life insurance protection along with investment potential.

- Can be useful for long-term planning like estate planning.

Downsides:

- High fees: Bundled products come with complex layers of fees, including insurance premiums, management fees, and administrative costs.

- Lower returns: Because of these fees, bundled products often underperform compared to simpler investments like unit trusts or ETFs.

- Lack of flexibility: Many bundled products have lock-in periods and surrender fees, meaning it can be costly to exit the policy early if you want to reallocate your investments. This restricts your ability to adapt to market changes or personal financial needs.

Insurance agents often push bundled products due to the high commissions they earn. While bundled products may suit certain investors, they are not always the best option, and it’s important to consider the real cost of those high fees.

Bank Relationship Managers

Bank relationship managers, on the other hand, often promote structured products. These are investment solutions tied to the performance of underlying assets (like stocks, bonds, or commodities), often with a fixed term.

Benefits:

- Some structured products offer capital protection or fixed returns if certain conditions are met.

- They can be tailored to specific investment goals and risk profiles.

Downsides:

- Complexity: The way structured products calculate returns can be difficult to understand. For example, a structured product might promise 5% returns, but if certain market conditions aren’t met, you could end up with much lower returns or none at all.

- High fees: These products also come with a variety of hidden charges, often eroding the returns.

- Risk of loss: Despite the appearance of protection, structured products carry significant risks if the market doesn’t perform as expected. You could end up with lower returns or even a loss on your initial investment.

Understanding Your Advisor’s Investment Strategy: Buy and Hold Isn’t Always Best

When working with a financial advisor, it’s essential to understand their investment strategy. Many advisors follow a buy-and-hold mindset, meaning they hold onto assets long term, expecting growth over time. While this can work in stable market conditions, it’s risky in a rapidly changing world.

Markets are evolving, and holding onto an asset for too long without adapting to market changes can result in missed opportunities or financial loss. Take the 2008 financial crisis: many long-term investors saw their portfolios drop by 40% or more, and those who held on for too long lost substantial value. On the other hand, proactive investors who adjusted their portfolios recovered faster and preserved more wealth.

Your investment advice should be seen as part of a long-term partnership with your advisor. Make sure they are proactive and able to make timely changes in response to evolving market conditions. Ask how often they review and adjust portfolios and whether they’re committed to protecting your wealth as markets shift.

An Alternative: Unit Trust Portfolio Solutions

For more flexibility, consider unit trust portfolios. Many wealth managers offer these as an alternative to bundled products and structured products. Unit trusts allow you to invest in a diversified portfolio of various asset classes without the complications of insurance bundling or fixed terms.

Benefits of Unit Trusts:

- Lower fees: Unit trusts generally come with lower management fees than ILPs or structured products. There are no additional layers of fees that will eat into your returns.

- No lock-in period: Unlike ILPs, unit trusts provide flexibility to access your funds when needed, without incurring hefty surrender charges.

- Diversification: Unit trusts spread your investment across multiple assets, reducing risk. For example, a balanced unit trust might invest in stocks, bonds, and other assets, helping to smooth returns even during market downturns.

Choose Investments with Your Eyes Open

Investing is critical to growing your wealth, but it’s equally important to focus on net returns, understand the risks, and be aware of fees. Whether you work with a wealth manager, insurance agent, or banker, always ask the tough questions: What are the fees? What are the risks? What are the alternatives?

Wealth managers can help guide you through the investment process, but transparency is key. Make sure your investment choices align with your long-term goals—not just your advisor’s commission.

Written By:

Jonathan Wong

Edited by:

Yee Shen Hao

If you enjoyed this article, don’t miss TWSG’s quarterly investment seminar on Tuesday, 14 January 2025, where we’ll dive into President Trump’s upcoming policies and discuss portfolio positioning for 2025. We’ll also cover important insights on legacy planning.

The session will be hosted by TWSG’s Director & Portfolio Manager, William Lim, and Wealth Manager, Fion Ho.

Dinner will be provided!

![]()