As we enter 2024, a surge in public interest in Supplementary Provident Fund Retirement Scheme (SRS) investments is expected.

Yee Shen Hao, Financial Services Manager at PhillipCapital, sheds light on the rising demand for SRS investments and further explains how long-term investors perceive it as an investment opportunity, when market conditions are volatile.

Lianhe Zaobao 联合早报 article in Chinese featuring Yee Shen Hao was originally posted on:

https://www.zaobao.com.sg/…/singa…/story20231227-1458462

English translation:

As the end of the year approaches, public demand for investment in the Supplementary Retirement Scheme (SRS) is expected to increase.

Hugh Chung, the Chief Investment Advisory Officer of Endowus, revealed in an interview with Lianhe Zaobao that more than one-third of the platform’s local customers use SRS funds to invest. He expects the savings into SRS accounts to surge in December because investors tend to save money at the end of the year in order to receive tax deductions. For example, in December last year, the number of customers investing with SRS doubled from November.

Yee Shen Hao, a Senior Wealth Manager at PhillipCapital, observed that when the market is performing well, the demand for SRS investment often rises in the fourth quarter. However, if the market is volatile, long-term investors will regard this as an investment opportunity and increase their demand for SRS deposits and investments during this period of time.

About 20% of Yee’s clients use SRS funds for investments with the majority of the investments being long-term investments with a term of more than 15 years. They have a high risk appetite and generally invest in a diversified global index fund portfolio.

SRS is a voluntary retirement savings scheme launched by the Ministry of Finance in 2001. It uses tax deductions to encourage people to deposit their cash savings into this account for investment. In order to reduce their taxes during tax filing season in the following year, individuals must deposit money into their SRS account before December 31.

Individuals who are over 18 years old and are not bankrupt can open their SRS accounts at three local banks. Singaporean citizens can deposit up to S$15,300 into their SRS account each year, while foreigners can deposit up to S$35,700 into their SRS account each year. This amount will be directly offset against an individual’s chargeable income, thereby reducing the amount of income tax the individual has to pay.

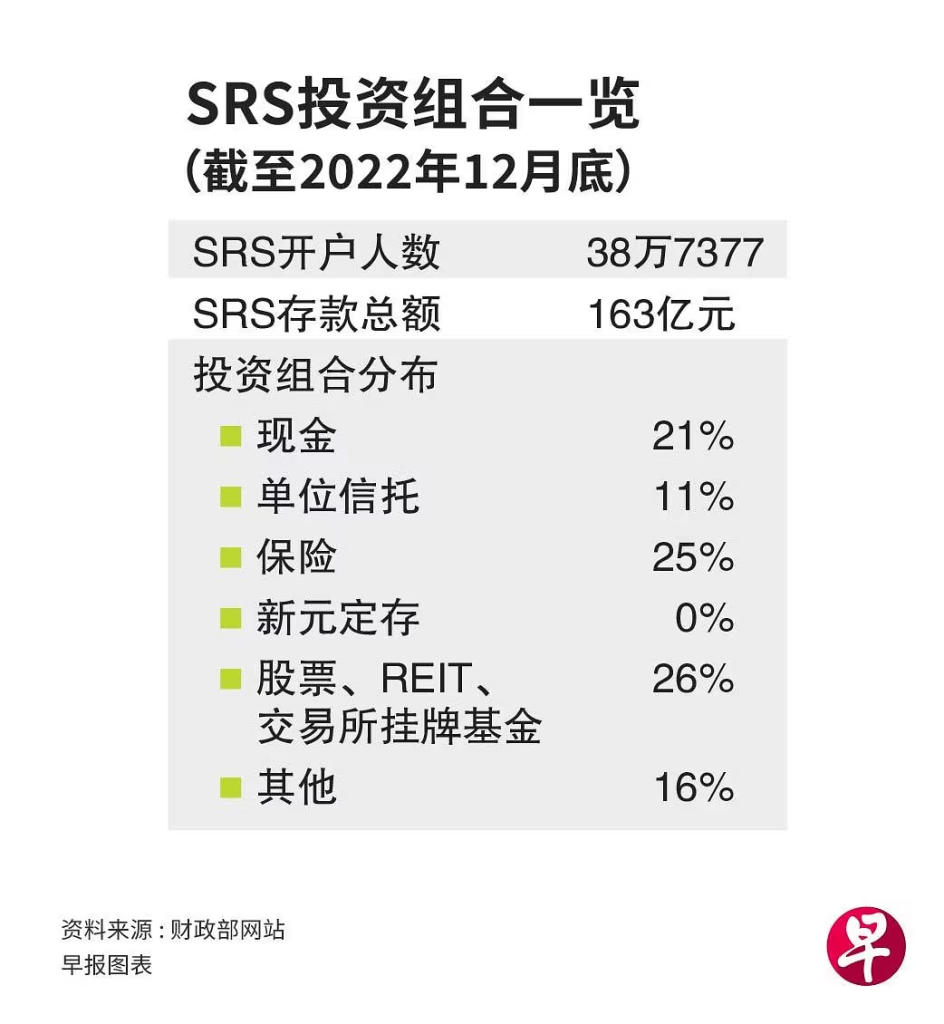

According to data released on the Ministry of Finance’s website, as of the end of 2022, more than 380,000 people had opened SRS accounts which is a 34% increase from the previous year. Overall funds increased by 13.7% to S$16.3 billion. Out of which, 21% of the funds, or S$3.4 billion, are stored in the form of cash. Although this ratio has been declining year by year, it still means that the public is not taking full advantage of their SRS funds to earn higher interest rates.

Yee Shen Hao reminded: “Even in the current high interest rate environment, uninvested SRS funds can only obtain an interest rate of 0.05%.” This is far lower than most bank fixed deposits and promotional savings account interest rates.

Products currently investable by funds in SRS include Bonds, Singapore Savings Bonds, Singapore Government Bonds, Treasury Bills, Fixed Deposits, Unit Trusts, Singapore-listed Stocks and Single Premium Insurance. Online investment platforms popular with young people such as Tiger Brokers and MooMoo currently cannot be invested with funds in SRS accounts. Investors can only invest in Unit Trusts with overseas exposure and SGX-listed funds.

SRS may have more products available in the future

Moving forward, SRS expects to have more products available for investment. Three local banks have recently appealed to the Competition and Consumer Commission of Singapore to make a decision on whether the proposed Supplementary Retirement Scheme Framework infringe Section 34 of the Competition Act 2004.

The proposed framework includes qualification conditions for SRS product, as well as guiding principles for SRS product suppliers to ensure fair competition in this market.

In response to inquiries from Lianhe Zaobao, the three banks said that some product providers, such as robo-investment advisors, fund companies, investment management companies and insurance companies, have already applied to be product suppliers for SRS investments, allowing customers to use SRS funds to invest in their products.

According to the proposed framework of the three banks, product suppliers that want to join must meet the requirements set out by SRS. Firstly, since SRS funds are retirement funds, the risk level of SRS products must be relatively low. Secondly, the product must be simple and easy to understand. Pricing and other terms of the product must be made transparent to customers.

The framework is currently under review by the Competition and Consumer Commission of Singapore and is expected to come into force in the second half of next year.

There are currently four investment management institutions under the SRS scheme, including iFAST Financial Pte Ltd, Phillip Securities, UOB Kay Hian, and GROW with Singlife (formerly known as Navigator Investment).

来自/ 联合早报

文/ 胡渊文

年底将至,公众对公积金退休辅助计划(SRS)的投资需求预料增加。Endowus首席投资顾问丁郁接受《联合早报》访问时透露,平台在本地的客户中,有超过三分之一使用SRS资金投资,他预计12月份需求会激增,因为投资者往往在年底把钱存入SRS以获得税务扣税额。例如去年12月,用SRS投资的客户比11月增加一倍。

辉立资本(PhillipCapital)资深财富经理余绅豪观察到,当市场表现一帆风顺时,往往第四季的SRS投资需求上升。不过,市场如果波动大,长期投资者会把这视为投资机会,在这期间的SRS存款和投资需求增加。

他的客户当中约有两成动用SRS资金投资,多数以SRS进行长期投资,期限超过15年,风险胃口较高,一般上投资多元化的全球指数基金组合。

SRS是财政部于2001年推出的自愿退休储蓄计划,以扣税作为优惠,鼓励人们把现金储蓄存入这个账户进行投资。若要在来年报税季节降低税务,须得在12月31日之前把钱存入SRS户头。年满18岁及没有破产者,可到三家本地银行开设SRS户头。国人每年可在SRS户头存入多达1万5300元,外籍人士则能存入3万5700元。这笔款项将直接抵消应缴税收入(chargeable income),从而减少缴付的税款。

根据财政部网站公布的数据,截至2022年底本地共有超过38万人开设SRS户头,比前一年大增34%。整体款项增长13.7%至163亿元,但其中高达21%的款项、也就是34亿元以现金形式储存。虽然这个比率已经逐年下滑,但仍然意味着公众没有充分利用SRS赚取更高利率。

余绅豪提醒说:“即使在目前的高利率环境下,未投资的SRS资金也只能获得0.05%的利率。”这远低于多数银行定期存款和优惠储蓄户头利率。

目前SRS可投资的产品包括债券、新加坡储蓄债券、新加坡政府债券、国库券、定存、单位信托、新加坡挂牌的股票和单期保费保险。受年轻人欢迎的网上投资平台如老虎证券(Tiger Brokers)和MooMoo目前不能用SRS投资。投资者只可投资有海外曝险的单位信托以及新交所挂牌基金。

SRS未来或有更多铲平可选

接下来SRS预计会有更多产品供投资。三家本地银行日前向新加坡竞争与消费者委员会提出申请,就拟议联合实施的公积金退休辅助计划框架是否违反《2004年竞争法》第34条做出决定。

拟议框架包括了SRS产品供应商和产品的合格条件,以及针对SRS产品供应商的指导原则,确保这个市场的公平竞争。

三家银行回复《联合早报》询问时说,一些产品提供商例如智能投资顾问、基金公司、投资管理公司和保险公司,已经申请要加入成为SRS提供商,让客户可用SRS资金投资他们的产品。

根据三家银行的拟议框架,供应商和产品若要加入SRS,得要满足SRS设定的要求。首先,由于SRS资金是退休资金,SRS产品的风险水平是保守的。其次产品必须是简单易懂的。产品的定价和其他条款须是透明的。

这个框架目前在接受竞争局的评估,有望在明年下半年生效。

目前SRS计划下有四家投资管理机构,包括奕丰金融公司(iFAST Financial Pte Ltd)、辉立证券(Phillip Securities)、大华继显(UOB Kay Hian),以及GROW with Singlife(前称Navigator Investment)。

Credits:

Phillip Wealth Advisory Facebook:

https://www.facebook.com/PhillipWealthAdvisory/posts/872452941547840

PhillipCapital LinkedIn:

https://www.linkedin.com/feed/update/urn:li:activity:7151105479262240769

![]()